Insurance-linked securities

Insurance-linked securities

Insurance-linked securities (ILS) are financial instruments that allow investors to speculate on a variety of events, including catastrophes such as hurricanes, earthquakes and pandemics.

ILS have become popular with both insurers and investors in recent years. They allow an insurer to purchase additional protection for low-frequency, high-severity losses such as those connected to natural catastrophes. Meanwhile, investors are attracted to ILS because returns are not correlated with the financial markets thereby enabling diversification within their portfolios.

The size of the ILS market; Since 2015, only once has issuance in Q4 exceeded the $2 billion mark, so it is impressive that it is now more than $3 billion. Combined with the previous three quarters of the year, Q4 2019 issuance took the total outstanding market size to a record end-of-year high of $41 billion.

A fairly valued investment opportunity for ILS is one that compensates investors sufficiently for taking the insurance risk embedded in it (both on a stand-alone basis and within a portfolio).

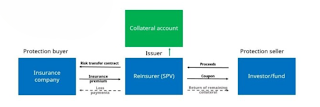

To issue an ILS in the security or derivative market, an insurer would first issue an SPV, or Special purpose vehicle. An SPV has two functions; it provides re-insurance for insurance companies and issues securities to investors.

Catastrophe (cat) bonds are a form of insurance-linked securities (ILS), also known as insurance securitization, where insurers transfer risk, usually from a catastrophe or natural disaster through a sponsor, typically a reinsurer, to investors.

The question is how is capital market linked with insurance industry?, through the securitization of insurance risk, an insurance company transfers underwriting risks to the capital markets by transforming underwriting cash flows into tradeable financial securities. The cash flows resulting from the securities issued are contingent upon an insurance event or risk.

ILS also provide investors with an opportunity to invest in insurance and reinsurance markets other than by purchasing shares in insurance companies directly.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.