Agreed Value OR Guaranteed Value

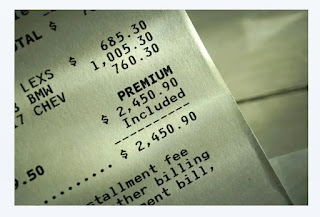

Agreed Value OR Guaranteed Value It is the amount your insurance company will reimburse you when the insured item is damaged or lost. Agreed value differs from other policies in that you are guaranteed to get the full amount agreed upon in your policy in the event of a loss. An agreed value is set at the beginning of each period of cover. Value doesn’t change during the period of cover. The agreed value is calculated based on the saleable value of the insured property. Note that the saleable value and replacement cost are not the same. Saleable value at a given point is calculated by deducting depreciation from replacement cost. Most at times we prefer the market value to the agreed Value. Generally speaking, marker value has the advantage of offering lower premiums for policy holders. For example the market value of your vehicle is likely to be less than any valuation of your vehicle you would agree with your insurance provider. The difference between agreed value and sum insured...