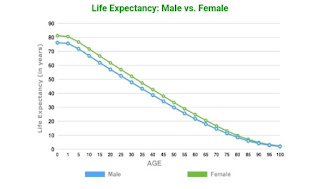

Life Expectancy

Life Expectancy The average number of years of life remaining for a group of people of a given age according to a particular mortality table. However, it remains a valuable tool for insurance companies to assess risk, price products competitively, and maintain financial stability. It is important to note that individual lifespans can vary significantly and this is how its important to insurance. 1. Pricing: Life insurance premiums are directly linked to life expectancy. The longer your expected lifespan, the lower the risk of the insurance company needing to pay out the death benefit, therefore, lower premiums. Conversely, a shorter life expectancy translates to higher premiums due to the increased risk of payout. 2. Product Design: Life insurance products vary in terms of coverage period, payout options, and premiums. Life expectancy data helps insurers design products that cater to different customer needs and risk profiles. Products like whole life insurance, with potentially