Incontestability Provision/Clause

Incontestability Provision

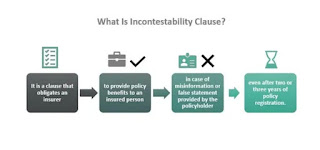

An incontestability provision, also known as an incontestability clause, is a provision in an insurance policy that limits the insurer’s ability to contest the validity of the policy after a certain period of time has elapsed. This means that the insurer cannot deny coverage or rescind the policy based on misstatements or omissions in the application after the contestability period has ended.

An incontestability clause is a clause in most life insurance policies that prevent the provider from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. A typical incontestability clause specifies that a contract will not be voidable after two or three years due to a misstatement.

Incontestability clauses help protect insured people from firms who may try to avoid paying benefits in the event of a claim. While this provision benefits the insured, it cannot protect against outright fraud.

There are a few exceptions to the incontestability provision. The insurer may still be able to deny coverage or rescind the policy if:

-The policy was obtained through fraud.

-The policyholder intentionally concealed a material fact about their health or medical history.

-The policyholder was not the insured person at the time the policy was issued.

The purpose of an incontestability provision is to protect policyholders from having their coverage denied after they have paid premiums and relied on the policy for a significant period of time. It also encourages insurers to carefully underwrite policies at the outset, rather than waiting until a claim is filed to investigate the policyholder’s application.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.