Life Expectancy

Life Expectancy

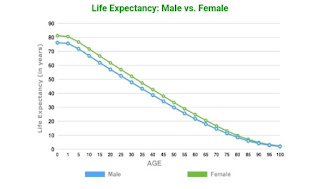

The average number of years of life remaining for a group of people of a given age according to a particular mortality table. However, it remains a valuable tool for insurance companies to assess risk, price products competitively, and maintain financial stability.

It is important to note that individual lifespans can vary significantly and this is how its important to insurance.

1. Pricing: Life insurance premiums are directly linked to life expectancy. The longer your expected lifespan, the lower the risk of the insurance company needing to pay out the death benefit, therefore, lower premiums. Conversely, a shorter life expectancy translates to higher premiums due to the increased risk of payout.

2. Product Design: Life insurance products vary in terms of coverage period, payout options, and premiums. Life expectancy data helps insurers design products that cater to different customer needs and risk profiles. Products like whole life insurance, with potentially lifelong coverage, rely on accurate life expectancy calculations to ensure financial stability.

3. Reserves and Solvency: Insurance companies use life expectancy data to calculate the amount of money they need to hold in reserves to meet future claims obligations. This calculation ensures they have sufficient funds to pay out benefits as promised, maintaining solvency and customer trust.

4. Underwriting: When assessing an individual's life insurance application, insurers consider various factors, including age, health history, lifestyle habits, and family medical history. This information, along with life expectancy tables, helps underwriters determine the applicant's risk profile and set appropriate premiums.

5. Annuity Payments: For annuities, life expectancy influences the payout structure. Annuity payments can be structured as a fixed amount for a set period or for the lifetime of the annuitant. Accurate life expectancy calculations help determine the appropriate payment schedule to ensure the individual receives income throughout their expected lifespan.

Life expectancy plays a crucial role in insurance, particularly in various types of life insurance and annuity products.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.