Level Premium Insurance

Level Premium Insurance

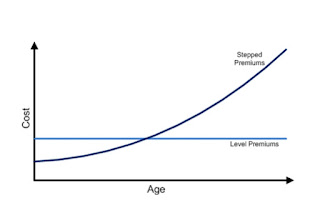

A life insurance policy for which the cost is equally distributed over the term of the premium period, remaining constant throughout.

This can be a good option for people who want to budget for their life insurance costs and know that their premiums will not increase.

Premium payments often start at a higher level than policies with similar coverage but are ultimately worth more than competitors as policyholders experience increased coverage over time at no additional expense.

Permanent insurance like whole life with level-premiums will typically see the death benefit increase over time even as the premiums remain the same.

The most common terms are 10, 15, 20, and 30 years, based on the needs of the policyholder. Level-premium policies are different than standard term life insurance policies, which have premium rates that rise as the policies age.

Unlike stepped premiums, where the premium you pay increases with your age, while with level premium structure, you will be charged more in earlier years and less in later years than stepped premiums.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.