Level Term Life Insurance

Level Term Life Insurance

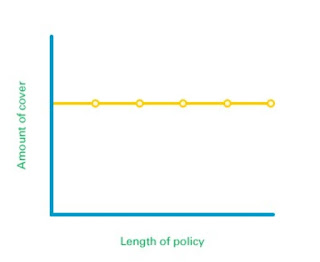

Level term life insurance is a type of life insurance that provides a death benefit for a specific period of time, known as the term. The premiums for level term life insurance are level, meaning they do not increase over time.

The death benefit is also level, meaning it will be the same amount regardless of when the insured person dies during the term of the policy. Your beneficiaries will get paid the same amount regardless of whether you die in the third year or 23rd year of your 30-year policy.

Level term is the direct opposite of a decreasing term life insurance.

Decreasing term life is life insurance with a decreasing death benefit.

That means your coverage will drop over time, hopefully in line with a decrease in your need for coverage.

Level term life insurance is a good option for people who need coverage for a specific period of time, such as to pay off a mortgage or college loans. It is also a good option for people who want to keep their premiums low.

Term life premiums are based on a person’s age, health, and life expectancy.

What to do when your level term life insurance comes to an end;

-Convert your term policy into a permanent life insurance policy.

-Purchase a new level term policy.

-Go without life insurance which is not advisable.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.