Broker

Broker

An insurance broker is a licensed professional who helps individuals and businesses find the right insurance policies for their needs. They represent the client, not the insurance company, and work to find the best possible coverage at the best possible price.

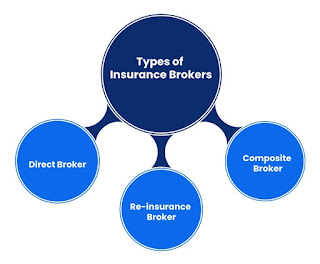

An insurance broker can be direct broker, reinsurance broker or composite broker.

These individuals/entities work on behalf of the customer and are not restricted to selling policies for a specific company but commissions are paid by the company with which the sale was made.

Insurance brokers are typically paid a commission by the insurance companies that they place policies with. This commission is usually a percentage of the premiums that you pay.

The reason we need a broker: the Broker will help you identify your individual and/or business risks to help you decide what to insure, and how to manage those risks in other ways. Insurance brokers can give you technical advice that can be very useful if you need to make a claim.

The different between a agent and a broker is that an agent represents one or more insurance companies. He or she acts as an extension of the insurer.

A broker represents you the insurance buyer/client. Agents serve as representatives of insurance companies and may be captive or independent.

They have access to a wider range of policies: Insurance brokers have access to policies from many different insurance companies, which gives you more options to choose from.

They can help you find the best price: Insurance brokers are experts in the insurance market and can help you find the best possible price for your coverage.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.