Risk Exposure

Risk Exposure

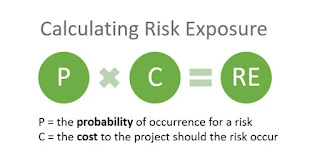

Risk exposure is the possibility of financial loss based on the probability of an event occurring.refers to an individual, organization, or asset arising from uncertain events. It's essentially the vulnerability to harm or loss that arises from exposure to threats or hazards.

Some examples of risk exposure in different contexts:

Individuals: An individual's risk exposure might include the risk of losing their job, getting sick, or being involved in an accident.

Businesses: A business's risk exposure might include the risk of losing customers, experiencing a data breach, or being sued.

Governments: A government's risk exposure might include the risk of natural disasters, cyberattacks, or terrorist attacks.

Key components of risk exposure:

Threats: These are potential events that could cause harm or loss. Examples include natural disasters, accidents, cyberattacks, financial market downturns, legal liabilities, and more.

Hazards: These are specific situations that increase the likelihood of a threat occurring. For example, a poorly maintained building might be a hazard that increases the risk of a fire.

Vulnerability: This refers to the weaknesses or deficiencies that make an individual, organization, or asset susceptible to harm from a threat. For example, a company with poor cybersecurity practices might be more vulnerable to a cyberattack.

Impact: This is the potential severity of the loss that could occur if a threat materializes. For example, a small business might be more severely impacted by a natural disaster than a large corporation.

Understanding risk exposure is crucial for individuals and organizations alike, as it allows them to: identify and prioritize risks, develop risk management strategies, and make decisions.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.