Risk Pooling

Risk Pooling

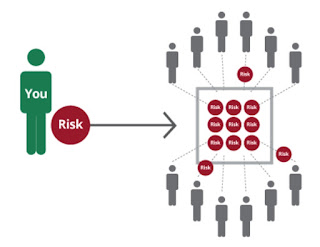

Risk pooling simply means sharing the potential costs of risks among a large group of individuals or entities. By combining everyone's resources, the financial burden associated with any individual experiencing a loss becomes smaller and more manageable. This principle forms the foundation of all insurance models.

There are basically two types of Risk Pooling:

A. Formal insurance: Offered by companies, where individuals pay premiums and receive specific coverage in case of certain events.

B. Informal risk-sharing arrangements: Groups like communities or families may create their own systems for mutual aid and support in times of need.

When considering rusk pooling we understand individuals with a higher risk of making claims might be more likely to join the pool, which gives rise to the principle of moral hazard making the insurance more riskier. This is why a good mechanism must be put in place to ensure contribution and distribution of resources within the pool is govern fairly.

The principle of risk pooling is simple:

-Individuals or entities contribute a premium based on their perceived risk (e.g., age, health, driving record) into a common pool.

-When a member experiences a loss covered by the insurance, the pool uses the collected premiums to compensate them.

-The risk of a large individual loss is spread across the entire group, making it more affordable for everyone.

Risk pooling is benefial in that it provides:

-Financial protection: Even individuals with limited resources can afford to protect themselves against potentially large losses.

-Predictability: By pooling resources, the potential for significant fluctuations in individual costs is reduced, leading to greater financial stability.

-Social benefit: Sharing risks promotes solidarity and mutual aid within a community or group.

We hope this comprehensive explanation clarifies the concept of risk pooling in insurance and its broader applications. If you have any further questions or specific contexts you would like to explore, feel free to ask!

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.