Capitation Arrangement

Capitation Arrangement

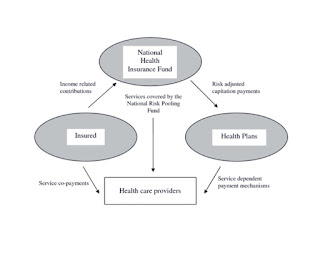

capitation arrangement is a payment structure where a healthcare provider (HCP) receives a fixed amount of money per patient per period instead of being paid for each service they provide. This amount is typically negotiated in advance based on the expected healthcare needs of the covered population.

Capitated payments are sometimes expressed in terms of a "per member/per month" payment. The capitated provider is generally responsible, under the conditions of the contract, for delivering or arranging for the delivery of all contracted health services required by the covered person.

Here's how it works:

-Managed care organizations (MCOs) like HMOs and PPOs use capitation to pay doctors and hospitals for their enrolled members.

-The payment is fixed regardless of how often patients seek care, incentivizing providers to manage costs and promote preventive care.

-The amount paid depends on factors like patient demographics, health status, and expected utilization of services.

-Providers may receive additional payments based on performance measures like quality of care and patient satisfaction.

Benefits of Capitation:

1-Cost control: MCOs can manage healthcare costs by setting predictable budgets.

2-Preventive care focus: Providers are incentivized to keep patients healthy through preventive measures to reduce future costs.

3-Administrative efficiency: Streamlined billing and payment processes.

Challenges of Capitation:

1-Provider concerns: Providers might prioritize cheaper treatments over optimal care or limit access to specialists to stay within budget.

2-Quality risks: Under-treatment or rushed care could occur if providers prioritize quantity over quality to maximize profit.

3-Patient concerns: Limited access to specialists or choice of providers.

Capitation is a complex topic with various perspectives. It's important to consider its benefits and challenges when evaluating its impact on different stakeholders in the healthcare system.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.