High Risk Occupation

High Risk Occupation

High-risk occupations can significantly impact your life insurance and other insurance premiums due to the increased likelihood of injury, illness, or death associated with the job. These factors directly influence the insurer's risk assessment and determine how much they need to charge to cover you

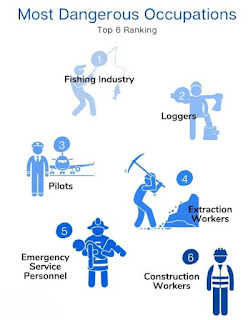

General high-risk occupations:

-Emergency services: Firefighters, police officers, paramedics, etc.

-Military personnel: Active duty and deployed personnel face inherent risks.

-Construction workers: Exposure to heights, heavy machinery, and hazardous materials.

-Transportation workers: Truck drivers, airline pilots, sailors, etc.

-Athletes and stunt performers: Increased risk of injuries due to their profession.

-Deep-sea divers and miners: Work in challenging and potentially dangerous environments.

Generally how do insurers analyze high risk occupations and whya Impact on different types of Insurance:

-Life insurance: Higher premiums, additional requirements like medical tests, or even declination of coverage in extreme cases.

-Health insurance: Potential exclusions for work-related injuries, higher deductibles, or limitations on coverage.

-Disability insurance: Exclusions for specific work-related disabilities or stricter eligibility criteria.

-Auto insurance: Higher premiums due to increased driving risks or specialized vehicle needs.

It is important we understand not all individuals within a high-risk occupation will automatically face higher premiums. Some insurers specialize in covering high-risk occupations, offering competitive rates and tailored coverage options.

Maintaining a good safety record and healthy lifestyle is a plus while seeking a high risk cover.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.