Retroactive Date

Retroactive Date

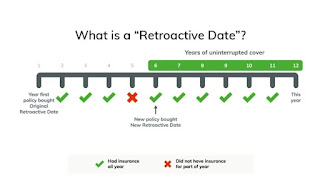

A retroactive date refers to a specific date established in a policy that determines the earliest incident for which the policy will provide coverage. It's most commonly found in claims-made policies, particularly those related to professional liability or errors and omissions (E&O) insurance.

A retroactive date defines how far back in time a loss can occur for your policy to cover your claim. If a claim happens prior to your retroactive date, your policy won’t provide benefits. It’s a feature of claims-made professional liability or errors and omissions insurance.

Example: Imagine you start a professional services business and purchase E&O insurance on July 1st, 2024, with a retroactive date of July 1st, 2023. This policy would cover claims arising from professional mistakes you made on or after July 1st, 2023, that are reported during the policy period (which began July 1st, 2024). Incidents before July 1st, 2023, would not be covered.

There are purposes for a retroactive dates;

1- Prevent "Burning Building" Scenario: It stops policyholders from obtaining coverage for already known issues or problems that are highly likely to result in a claim (e.g., buying fire insurance after your house starts burning).

2- Limit Coverage for Distant Events: It avoids covering claims from very old incidents, even if they were unknown at the time. This helps maintain affordability of the premiums.

Not All Policies Have Retroactive Dates: It's specific to claims-made policies. Occurrence-based policies cover incidents that happen during the policy period, regardless of when the claim is filed.

#BeNewinsurance #InsurTech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.