Open Perils Coverage

Open Perils Coverage

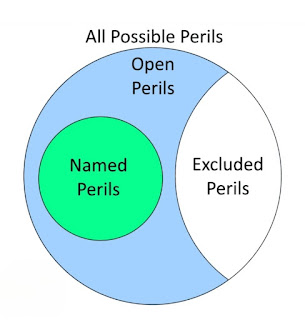

Open perils coverage is a form of commercial property insurance that provides protection against nearly every type of loss except those specifically excluded in the policy.

Open perils property insurance is different from NAMED perils insurance, which only provides coverage for losses specifically listed in the policy. For example, a named perils policy might only cover damage from these perils or hazards: Fire, Theft, Vandalism, Wind.

Open perils coverage is also sometimes called all perils insurance or all risk coverage.

What Are Some Common Exclusions Listed In An Open Perils Policy?

Some common exclusions in open perils policies include:

-Floods

-Mudslides

-Seepage and sewer backups

-Power failures

-Rust and corrosion

-Mechanical breakdowns

-Earthquakes

-Boiler explosions

-Employee theft

-Fungus damage

-Animal or insect pests

-Air or water pollution

Note that these are exclusions because you can buy specific covers for them.

In conclusion, Open Perils Coverage offers comprehensive protection for your property, but it comes at a higher cost. Carefully weigh the benefits and drawbacks and consider your specific needs before deciding if this type of coverage is right for you.

#BeNewinsurance #InsurTech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.