Difference In Conditions (DIC) Insurance

Difference In Conditions (DIC) Insurance

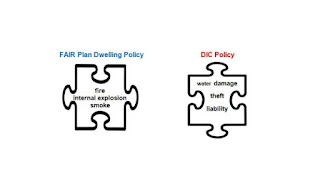

Difference in Conditions (DIC) insurance is a type of insurance that provides additional coverage for perils not covered by standard insurance policies. DIC insurance is designed to fill in gaps in insurance coverage and is most frequently used by larger organizations, looking for protection from catastrophic perils such as flood, earthquake, terrorism.

DIC insurance is designed to fill in gaps in insurance coverage and is most frequently used by larger organizations, looking for protection from catastrophic perils some mentioned above.

DIC insurance works by providing coverage for the difference in conditions between the local insurance policy and the master insurance policy. The master insurance policy is typically a policy that is purchased by a multinational corporation or an organization with operations in multiple countries. The local insurance policy is a policy that is purchased in each country where the organization has operations.

The DIC insurance policy will pay the difference in coverage between the local insurance policy and the master insurance policy. For example, if the local insurance policy does not cover floods, but the master insurance policy does, then the DIC insurance policy will pay the difference in coverage.

DIC insurance is most commonly used by larger organizations, such as multinational corporations and organizations with operations in multiple countries. This is because these organizations are more likely to be exposed to high-risk perils, such as floods, earthquakes and terrorism.

However, DIC insurance can also be beneficial for smaller businesses and organizations that want to protect themselves from the financial risk of a catastrophic event.

Overall, DIC insurance can be a valuable tool for businesses and organizations that want to protect themselves from the financial risk of a catastrophic event. However, it is important to weigh the pros and cons of DIC insurance carefully before deciding whether or not to purchase a policy.

#benewinsurance #insurtech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.