SURETY BOND

SURETY BOND

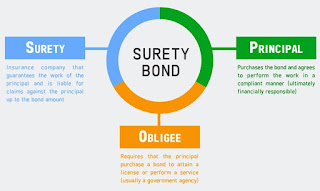

A bond in which the surety agrees to answer to the obligee for the non-performance of the principal (known as the obligor).

Surety bonds are financial instruments that function like a three-party guarantee. Here's how surety bonds work. The Three Parties Involved:

1- Principal: The person or business who needs the bond and guarantees completing a specific obligation.

2- Obligee: The party requiring the surety bond as a form of financial protection. It can be an individual, government entity, or another business.

3- Surety: The company that issues the bond and assumes the financial responsibility if the principal fails to fulfill their obligations.

This is how surety bonds work; If the principal defaults on their obligations as outlined in the bond agreement, the obligee can make a claim against the surety bond. The surety will then investigate the claim and, if valid, pay out the obligee up to the guaranteed amount of the bond. Subsequently, the surety will pursue the principal to recover the funds they paid out.

Common Uses of Surety Bonds:

1- Construction Contracts: Often required to ensure contractors complete projects according to specifications and pay subcontractors and suppliers.

2- License and Permit Bonds: Needed by various professions or businesses to obtain a license or permit from a government agency. This guarantees compliance with relevant regulations.

3- Fiduciary Bonds: Protect beneficiaries or estates from financial mismanagement by someone entrusted with those funds (e.g., court-appointed guardians).

Benefits of Surety Bonds:

A- Obligee Protection: Provides financial security to the obligee in case the principal fails to meet their obligations.

B- Contract Performance: Incentivizes the principal to fulfill the agreed-upon terms of a contract.

C- Business Opportunities: Surety bonds can be necessary for businesses to qualify for specific contracts or licenses

Surety bonds are typically issued by specialized surety companies (insurance companies) that underwrite the risk associated with bond. They assess the principal's financial strength and reputation before issuing a bond.

#BeNewinsurance #InsurTech #inclusiveinsurance #insurance #reinsurance #takaful

Comments

Post a Comment

Thank you for making this valuable comment.